PREMIUM FINANCING

LIFE ASSURANCE

WITH A DIFFERENCE

Funding Life Insurance Premiums

with no out of pocket expenses

Funding Life Insurance Premiums

with no out of pocket expenses

The Platinum Premium Finance Program (PFP) is a new and unique funding strategy available to US Nationals, as well as non-US persons with a US Nexus. The program allows eligible participants to fund Life Insurance premiums without having to take out a personal loan, provide a personal guarantee or incur out of pocket expenses. The Platinum PFP offers higher sums assured (policy death benefit) than traditionally financed life insurance contracts at a fraction of the cost. Our minimum sum assured starts at US$ 10,000,000.

Premium financing life insurance contracts traditionally use a process where the applicant takes a third-party loan to pay for the policy's premiums. This strategy is useful to those who don’t want to pay for costly life insurance premiums themselves, nor do they want to sell any of their liquid assets to fund their insurance needs.

The loan allows the applicant to get higher life insurance cover, and with it, the policy’s cash value is also higher. This leads to a substantially greater accumulated cash value for the insured. However, a traditional loan used to fund the policy premiums is for a short duration and must be renewed periodically. When renewed, rates and terms are often changed and can become unattractive due to changes in the interest rate environment.

The client will typically service the cost of a loan with annual bonuses declared by the insurer or from the proceeds of the policy's cash value. They will either pay the annual loan interest or capitalize the annual loan interest and thereby impact the policy cash value and the sum assured. The lender will often hold the life insurance policy as collateral in case of default or non-payment of the loan by the borrower/life assured.

A Premium financed life assurance policy is often used as an Estate Planning tool. Following the death of the insured, the proceeds of the life insurance policy are used to settle the estate taxes of the deceased. It is normal for such a high-value life insurance policy to be held in a trust account, separate from the client’s other assets.

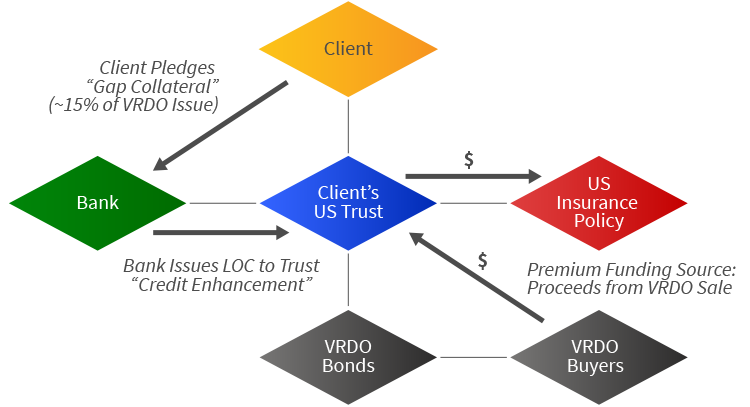

Unlike traditional premium financing, this method funds the insurance policy purchase by issuing Variable Rate Demand Obligation Bonds (VRDOs), to raise capital which is then used to pay for the insurance premiums and funding costs (including any annual interest charged). VRDO bonds have the lowest borrowing rates in the capital markets (7-30 Day London Interbank Offer Rate (LIBOR) with 30 to 50-year terms). As a result, the Platinum Program offers lower borrowing costs when compared to the traditional premium financing method of using individual bank loans.

The client’s only liability is to pledge (not liquidate to pay premiums) existing assets which are then used as the ‘Gap collateral’. All interest and/or capital appreciation of the VRDO assets is retained by the client.

Based on the applicant’s pledge, the lender (Top tier US bank) issues a Letter of Credit which is used to raise capital via an issuance of VRDO Bonds which is then used to pay premiums and service annual borrowing costs.

All of the costs of the premiums paid are funded by the VRDO bond issue. The client has no out of pocket expenses.

A client is able to receive typically 5 to 10 x higher sum assured compared to traditional life insurance policies with no upper limit!

The client has to be able to pledge at least US$ 1 Million worth of assets. Assets can be both liquid and illiquid and include stocks, funds & real and personal property.

A variable-rate demand obligation (VRDO) is a debt instrument that represents borrowed funds that are payable on demand and accrue interest based on a prevailing money market rate.

The VRDO bonds carry the highest Standard & Poor’s rating (AA+/A-1+) because they are credit-enhanced with a Letter of Credit provided by one of the program partner banks.

Typical purchasers of VRDO Bonds include companies such as Fidelity, Charles Schwab, Vanguard, USAA, and other large money managers and insurance companies.

As the Cash Value in the insurance policy grows, so does the total benefit to the client’s estate. All death benefits, accumulated cash value and other Life Policy proceeds are paid to the Trust beneficiaries once the lender has been repaid.